Australians top priorities in grocery shopping are convenience, quality and pricing – with the latter surprisingly coming in third.

Dunnhumby’s latest Australian Grocer Retailer Preference Index found that Woolworths is the go to “one-stop shop” for wide product variety while rival Coles is the chosen grocery for promotions and rewards. However, discount grocer Aldi beats them both on price.

“Aldi has built the strongest emotional connection with its customers by delivering consistently low prices, quality products and higher perceived ‘value’,”said Keri-Jane Jacka, commercial director ANZ, dunnhumby.

“Further, our findings show Aldi customers are more likely to recommend the retailer to their friends and family, and be sad if their nearest store closed. This strong emotive response suggests that Aldi has really strong brand equity – a driver for long-term customer loyalty and continued success in the market.”

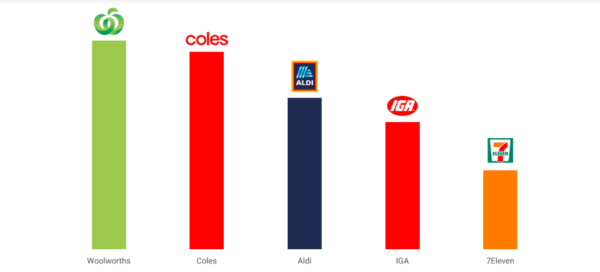

Woolworths beats Coles as Australians’ preferred grocery retailer with an RPI score of 95 versus 91. However, Aldi is hot on the heels, described as an ‘accelerating threat’ with an RPI score of 69. The discount grocer is growing three times faster than its competitors, and can potentially double its market share in the next 10 years, dunnhumby said.

“With Aldi outperforming on all price attributes and developing a real connection with its customers, in order to remain the preferred grocery retailers amongst shoppers, Woolworths and Coles must continue to invest in data-driven retail strategies to foster loyalty and build trust. They must offer lower prices across the board instead of focusing on discounts, and more convenient, easy shopping experiences that delight customers,”

Jacka said.

The index shows that the ‘big two’ supermarket giants, Woolworths and Coles, capture two thirds of shopper visits. One third of shoppers buy at Woolworths, Coles and Aldi in the last month.

The report found that Australian grocers face intense pressure from e-commerce and discounters that leverage customer data to engage and retain shoppers today. It’s the ‘new normal’ strategy for retailers to win and retain the modern shopper.

“Retailers need to be far more strategic in their approach to pricing and promotions. To remain competitive, they need to think introspectively on how they can maximise personalisation and create the most value for their customers by leveraging the huge amounts of customer data at their disposal,” Jacka said.

Five primary customer pillars

Dunnhumby reported that there are five primary customer pillars. These are convenience and quality; easy shopping experience; price; operations and drive time.

It ranked the five retailers with Woolworths ahead of Coles. Aldi comes in third as the “dark horse in the race”, while IGA and 7-Eleven currently trailing.

Convenience matters for Aussie shoppers

Aussies value time so convenience, quality and easy-shopping experience are on the top of their priorities for overall overall preference driver. But for Woolworths and Coles customers, it is less important as long as they are satisfied with their items.

Woolworths and Coles are the strongest on quality goods and convenience. IGA’s strongest in good customer service and clean stores. While Aldi offers also good quality products, but trails behind the two supermarket giants on convenience. 7-Eleven’s biggest issues are cleanliness and perishables, but the retailer wins in ready-to-eat items.